From Regulation to Innovation: Tackling the Microplastics Challenge with Emerging Technologies and Material Alternatives

Once a niche topic, discussions on microplastics now frequent headlines and policy agendas, fueled by mounting evidence of microplastics infiltrating ecosystems, food chains, and even the human body. It is not surprising that microplastics have become one of the pressing environmental concerns of the 21st century. As public awareness grows and regulatory scrutiny intensifies, industries and governments are being compelled to confront the scale and complexity of the microplastics crisis. In response, the market is evolving rapidly, spurring demand for innovative technologies, regulatory compliance strategies, and sustainable alternatives. IDTechEx‘s latest report, “Microplastics 2025: Regulations, Technologies, and Alternatives” offers a deep analysis of the shifting regulatory landscape to tackle microplastic pollution with critical analysis of material alternatives, emerging technologies, and the key players.

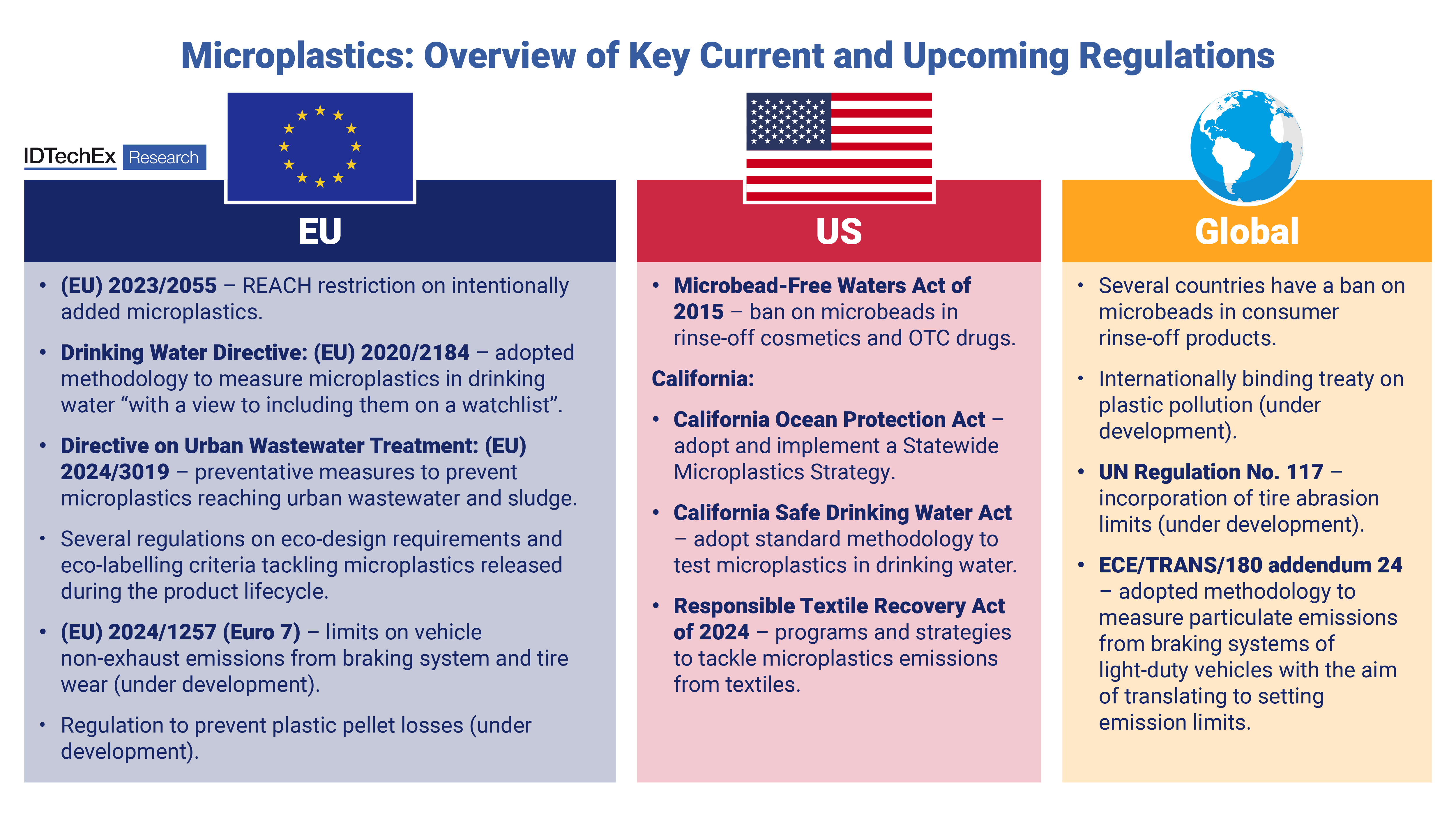

Examples of current and proposed regulations related to curbing microplastics pollution. Source: Microplastics 2025: Regulations, Technologies, and Alternatives by IDTechEx.

Although a significant portion of microplastics originates from the degradation of larger plastic items in the environment, microplastics are also intentionally used as functional additives in a wide range of products across various industries. These include consumer products, agricultural products (fertilizers, seed coatings), pharmaceuticals, paints and coatings, medical devices, and several others. Microplastics not only enhance mechanical properties (e.g. elasticity and scratch resistance of paints and coatings) and encapsulate actives for controlled release (in pharmaceuticals, cosmetics, detergents), but they are also used as opacifiers, rheology modifiers, and many more.

An Evolving Regulatory Landscape

Regulatory momentum around microplastics is accelerating, with the European Union leading the charge. As one of the earliest and most comprehensive movers, the EU has implemented sweeping measures targeting intentionally added microplastics across a wide range of applications. Other jurisdictions are also increasingly exploring regulations and policy action to tackle microplastics, including the global plastics treaty currently under negotiation.

Beyond bans on specific product categories, regulations are expanding to cover broader aspects of the plastic lifecycle. Key areas under increasing scrutiny include minimizing plastic pellet losses throughout the supply chain, addressing microplastic emissions from tire and brake wear in automotives, and monitoring microplastic levels in drinking water. Additionally, the use of sewage sludge as agricultural fertilizer (which is often a concentrated source of microplastics) is drawing heightened regulatory attention. IDTechEx’s latest report provides a regulatory landscape with a comprehensive analysis of current and proposed regulations on microplastics, with insights into key global trends, the main challenges, and outlook.

Innovations in Detection and Capture Technologies

Microplastics are heterogeneous in nature. They have a wide variability in dimensions, composition (e.g. type of polymer, presence of additives), shape (e.g. particles, fibers, etc.), and can have physicochemical properties altered by weathering, ageing, or fouling processes once in the environment. All of these factors introduce several challenges in detecting, identifying, and quantifying microplastics reliably with a high degree of accuracy. Additionally, detection limits of instrumentation or the analytical technique used can also make it challenging to obtain comparable datasets. Similarly, for microplastics filtration and capture technologies, the same factors outlined above make the removal of microplastics very difficult, especially once released into the environment.

With emerging regulations being a key driver, there is growing innovation in developing and scaling capture and detection technologies, for example, at wastewater treatment facilities, to upstream interventions such as microfiber filters for washing machines and laundry facilities. IDTechEx’s report discusses market activity, provides an overview of relevant standards, patents, and technology development, with insight into key players and startups pioneering solutions.

Market Outlook: Challenges and Opportunities

The regulatory momentum is pushing manufacturers and supply chains to pivot. In addition to implementing microplastic capture technologies to prevent microplastics from entering the environment, biodegradable alternatives are also gaining increasing attention to mitigate the generation of persistent microplastics. For example, several players such as BASF, Syngenta, Kuraray, and Covestro are starting to introduce biodegradable agricultural products such as agricultural mulch, seed coatings, and binders into the market in recent years, driven by the EU’s REACH restriction on microplastics. However, more research and development in this space is ongoing. Other players are also developing alternative micro-encapsulation technologies for controlled release of actives such as fertilizers, pesticides, fragrances, etc.

As the microplastics regulatory landscape develops, industries and decision-makers require accurate, forward-looking insights to stay competitive. IDTechEx’s dedicated report “Microplastics 2025: Regulations, Technologies, and Alternatives” offers a comprehensive analysis of current trends and shifting regulatory developments. It identifies key sources of microplastic pollution and examines leading-edge developments in detection, capture, and filtration technologies. The report also evaluates promising material alternatives such as biodegradable plastics and delivers critical insights into ongoing challenges and the future outlook for stakeholders navigating this emerging field.

Source: idtechex.com