Quantum sensors leverage control over fundamental particles to enable highly sensitive measurements of a range of physical properties, including electric and magnetic fields, current, gravity, linear and angular acceleration, timing, and light.

Quantum sensors are quickly gaining interest for applications across electric and autonomous vehicles, brain scanners, quantum computers, underground mapping equipment, satellites, microscopes, and even consumer electronics. Furthermore, growing hype and synergistic development with quantum computing and communications are driving interest and investment into the quantum technology sector unlike ever before.

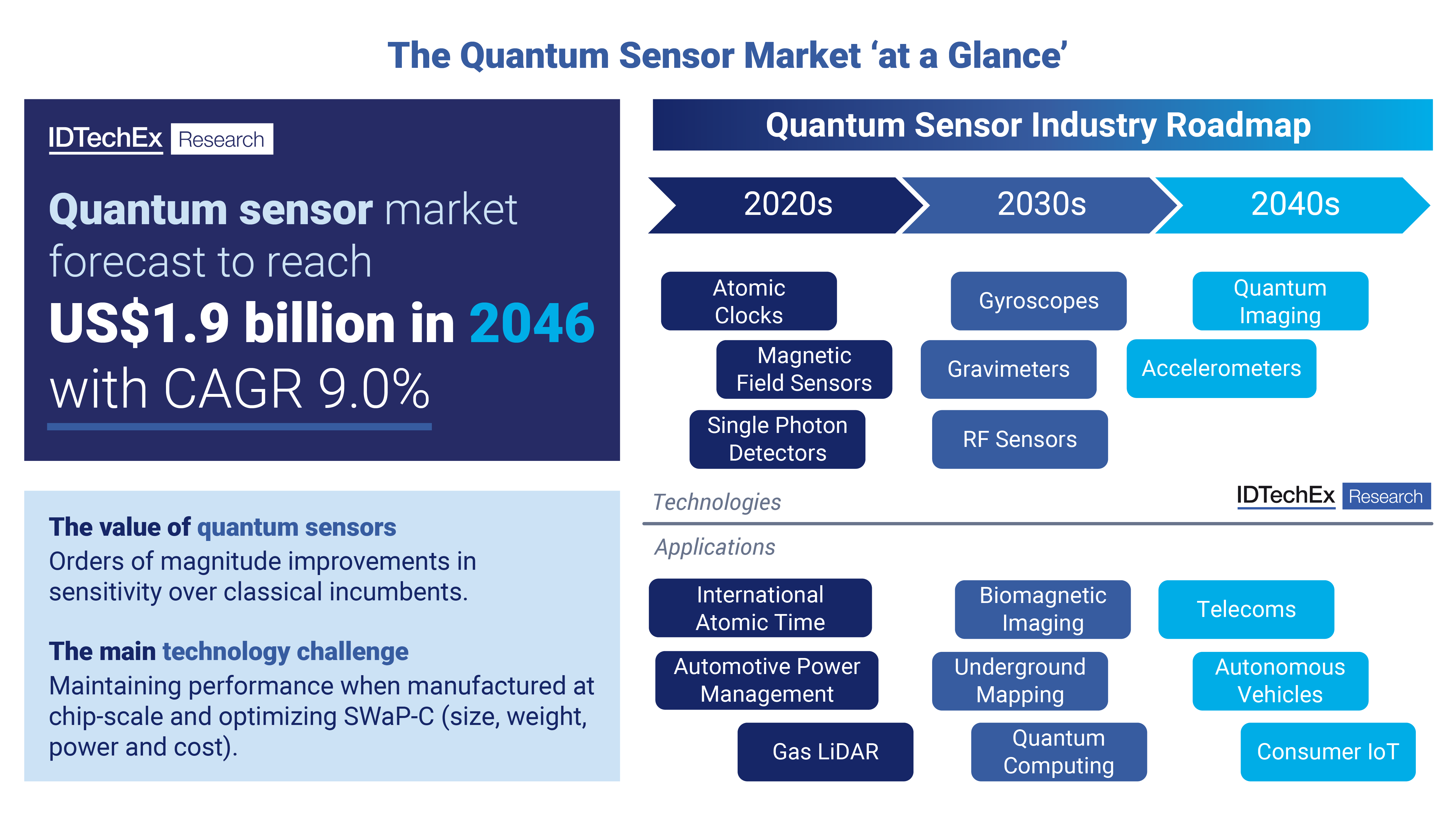

This burgeoning technology is anticipated to generate revenues of over US$1.9 billion by 2046, with an average CAGR of 9.0% over the next twenty years. IDTechEx‘s Quantum Sensor Market 2026-2046 report provides an extensive analysis of the quantum sensor market, including over 40 company profiles based on primary information from technology developers and end users.

Covering a diverse range of platforms and applications, “Quantum Sensors Market 2026-2046: Technology, Trends, Players, Forecasts” analyses 20 different quantum sensing technologies, including multiple types of atomic clocks, magnetic field sensors, and single photon detectors. For each technology, the operating principles, competitive landscape, key applications, and a granular 20-year forecast are presented.

Overview of the quantum sensor market. Image source: IDTechEx.

Quantum Capability for Vehicles, Medical Imaging, and More

In modern technology, sensors are deployed across vehicles, medical devices, consumer electronics, and more. Quantum sensors are set to enhance their capabilities across multiple industries, for example, by enabling GPS-denied navigation in vehicles through quantum gyroscopes and atomic clocks, or by unlocking highly accurate and accessible brain imaging through quantum magnetometers.

The quantum sensor market is diverse, with varied technology readiness levels (TRL) and addressable market sizes across the space. For example, millions of chip-scale tunnelling magneto resistance (TMR) sensors have already been sold into the automotive sector for remote current sensing, whilst navigation with quantum magnetometers is just entering the market through the efforts of companies like Q-CTRL and SandboxAQ.

Through technical interviews with both research centers and technology developers leading in this field, “Quantum Sensors Market 2026-2046: Technology, Trends, Players, Forecasts” assesses the technical and commercial readiness level of each underlying quantum sensing technology and provides a roadmap for their future development.

While a range of quantum sensors are being commercialized, market trends exist between the different categories of technology. This comprehensive report analyzes atomic clocks, quantum magnetic field sensors, quantum gyroscopes, quantum accelerometers, quantum gravimeters, quantum RF sensors, single photon detectors, quantum imaging, and components for quantum sensors. Each quantum sensor category is assessed using SWOT analyses and technical benchmarking tables. With many players releasing their first-generation products, a range of commercialized quantum sensors are benchmarked against each other and their classical incumbents.

Analyzing Quantum Sensors Through Materials and Components

Different types of quantum sensors can often be grouped together based on the sensing platform that they share. For example, atomic clocks, optically pumped magnetometers, and atomic quantum gyroscopes all rely on confined atomic vapors that are controlled with photonics and lasers. Meanwhile, artificial diamonds with implanted nitrogen-vacancy defects (also known as NV diamonds) are shaping up to be a promising emerging platform for quantum magnetometry, gyroscopes, or microscopy.

Quantum sensors based on NV diamonds are garnering attention due to their compact, robust nature and steady operation at room temperature. However, any wider adoption of NV diamond quantum sensors will hinge on players in the supply chain that specialize in manufacturing synthetic diamond for quantum applications, such as Element Six and Diatope.

With each of these different quantum sensing platforms comes an array of challenges in their manufacture and unmet needs that could further boost performance or enable miniaturization. While atomic clocks have already been brought down to the chip-scale, their premium cost limits current use cases to high-end navigation in aerospace and submersibles, and there is currently a trade-off between size and precision.

Ongoing efforts to reduce the cost of producing key components such as vapor cells and chip-scale lasers to optimize the production of atomic quantum sensors could unlock the state-of-the-art in timing for a wider market in autonomous vehicles or commercial aviation. By liaising with materials specialists and product developers, this report breaks down how the SWaP-C (size, weight, and power + cost) of quantum sensors could be improved to unlock higher-volume applications in future mobility, healthcare, or consumer electronics.

This new perspective on the quantum sensor market reveals synergies and opportunities for material providers deep into the value chain by grouping and analyzing sensors based on their material platform. This report explores the material properties and supply chain dynamics for a range of quantum sensing components, focusing not only on sensor OEMs but also materials suppliers and end users.

20-year Outlook for Quantum Sensing

Despite not grabbing as many headlines as quantum computing, quantum sensors are a breakthrough technology that could unlock higher-quality data for new applications across transportation, healthcare, computing, research, and consumer electronics.

The current state of the quantum sensing market sees several technologies entering commercialization, but the next decade will determine which players can minimize and mass-produce the technology to increase their accessible market. Developments across the quantum sensing space are often driven by innovations in materials and novel manufacturing methods.

Source: idtechex.com